Il ciclo economico statunitense ha un chiarissimo messaggio da darci: è iniziata la fine della ripresa, allacciate le cinture

Il biennio 2015-2016 porterà, con ogni probabilità, una nuova recessione negli Stati Uniti. Non crediamo che sarà qualcosa di paragonabile al 2008, ma è ben noto come, in genere, un ciclo economico abbia una durata di circa 7-8 anni.

Nel 2008 è iniziato un nuovo ciclo con il caso sub-prime e Lehman Brothers, e, se la matematica non è un’opinione, 2008 + 7 = 2015.

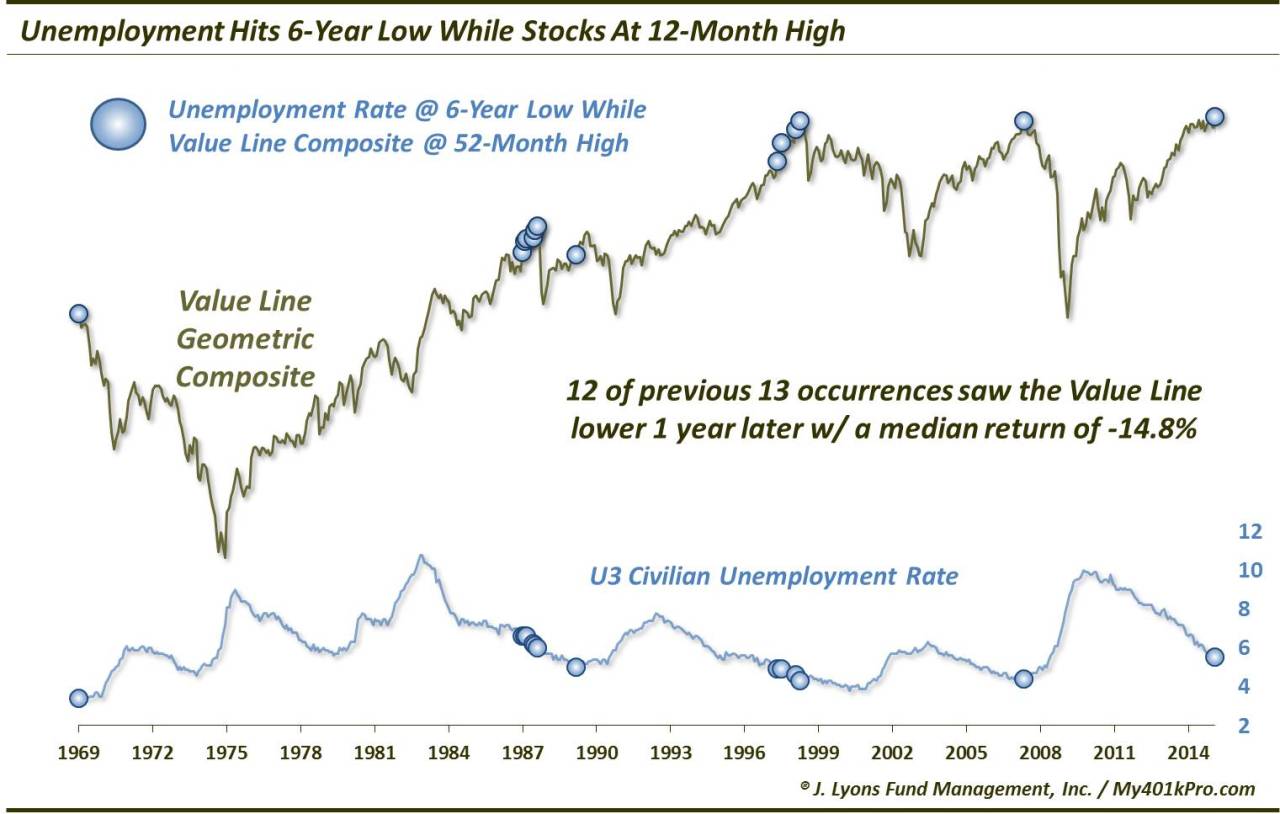

Vi stiamo dicendo dunque che, probabilmente, quest’anno o l’anno prossimo vedremo un ritorno naturale dell’economia in recessione, ed i segnali ci sono tutti. Oggi vogliamo mostrarvi l’andamento del mercato del lavoro con il tasso di disoccupazione:

Non serve altro, ci auguriamo soltanto che chi legge questo post sia responsabilmente pronto (ci riferiamo soprattutto a chi investe negli USA) ad una fase di contrazione dell’economia.

Non serve disperarsi, è il ciclo economico.

Salve. Bellissimo articolo!

Disoccupazione con dati allarmanti al 5,2%. È ora che il sistema crolli!

Cosa si inventeranno questo settembre?